Policies

Standard Bank of Angola has integrated several policies within the scope of corporate governance.

Tabela Informartiva

| Designation | Description and Principles | |||

|---|---|---|---|---|

|

Code of Conduct and Ethics |

Our Code of Ethics and Conduct provides the foundation for our policies, standards, and controls, ensuring that our values and ethics are reflected in how we make decisions and engage with stakeholders, and that we hold one another accountable for meeting the ethical and conduct standards set for the Bank. The Code is based on three pillars: i) Personal Conduct: How we treat one another as colleagues, how we build an inclusive and supportive culture, and how we support skill development and career progression. ii) Social Conduct: How we manage our impact on various stakeholders, society, and the environment. iii) Market Conduct: How we ensure our clients' interests are at the heart of our business activities, that clients are treated fairly, and that our market conduct is fair and reasonable. |

|||

|

Corporate Governance |

With the aim of upholding the principle of transparency in formalizing the structure for effective understanding of the model, a framework was adopted to achieve strategic objectives, promote organizational transparency, and perform institutional control and oversight by specifying the roles of different organizational units and the competencies, responsibilities, and authority levels of the various stakeholders in the institution. |

|||

|

Training Policy |

Establishes a clear line of responsibility within the hierarchy and the existence of monitoring, auditing, and compliance processes, both internal and external, which contribute to enhancing management transparency and thereby increase its value. |

|||

|

Remuneration and Benefits Policy |

At Standard Bank Angola, the remuneration and benefits policy is essential for the sustainable growth of the Bank. It plays a crucial role in attracting and retaining talent, ensuring employee motivation, and providing attractive remuneration and benefit opportunities. To ensure effective implementation of this policy, the following guiding principles are followed: The remuneration package reflects the relative proportions of fixed and variable pay (recognition) and is closely linked to the nature of the work and expected outcomes. Variable pay is considered an unsecured benefit, as it depends entirely on the Bank's financial performance and individual performance.

|

|||

|

Conflict of Interest Management Policy |

The conflict of interest policy aims to ensure that the Bank maintains and operates effective organizational and administrative mechanisms to take all reasonable steps to prevent Conflicts of Interest from creating or giving rise to a material risk of harm to clients' interests; ensuring that (i) conflicts of interest are avoided and managed within the Bank, including mechanisms to identify, avoid, mitigate, and disclose potential conflicts of interest; (ii) legal obligations are fulfilled. |

|||

|

External Business Interests Policy |

This policy is not applied in isolation. Its aim is to prevent conflicts of interest that may pose risks to the Bank, its clients, and suppliers. Employees' external business interests may result in potential conflicts of interest. Thus, the policy ensures that the Bank's activities align with its values and Code of Ethics by (i) establishing processes for the disclosure, approval, and maintenance of employees’ external business interests; (ii) creating a framework to mitigate potential reputational risk to the Bank, its clients, and suppliers due to such actions; (iii) establishing a framework for mitigating reputational risks; (iv) providing guidelines on internal control mechanisms to ensure key risks are managed throughout the employee lifecycle in the institution. |

|||

|

Personal Account Trading Policy |

The Personal Account Trading Policy ("Policy") is designed to comply with applicable legal and regulatory obligations, ensuring that: (i) Conflicts of Interest are managed fairly between the Bank, its Employees, and Clients; (ii) business is conducted in accordance with industry standards and relevant regulatory requirements; (iii) the Bank, the Group, and their Employees avoid sanctions from misuse of Bank, Group, and/or Client information considered as Material Non-Public Information ("MNPI") under any relevant Market Abuse framework; (iv) adequate controls for Personal Account Trading are implemented, established, and maintained. |

|||

|

Information Barriers and Need-to-Know Policy |

The Information Barriers and Need-to-Know Policy was designed to ensure that: (i) Client confidentiality is protected; (ii) actual, potential, and foreseeable conflicts of interest are properly managed; (iii) obligations to treat clients fairly and restrictions against misuse of Material Non-Public Information ("MNPI") are enforced; (iv) restrictions on sharing and using required information, including MNPI, are strictly followed. |

|||

|

Gifts and Entertainment Policy |

The Gifts and Entertainment Policy aims to develop controls to identify, avoid, mitigate, and disclose actual, potential, or apparent Conflicts of Interest that may arise from giving and receiving gifts and entertainment. |

|||

|

Information Transparency and Disclosure Policy |

The Information Transparency and Disclosure Policy aims to set out the principles, guidelines, and rules to be followed in the Bank’s information transparency and disclosure efforts, ensuring an appropriate standard of transparency that should guide the Bank's activities in line with legal and regulatory requirements and market best practices. |

|||

|

Accounting |

The Bank has implemented processes and policies under corporate governance and the internal control system to ensure the appropriate recording of transactions in accounting records, the adoption of suitable accounting criteria and policies, and the maintenance of an internal control structure that enables the preparation of true and fair financial statements. |

|||

|

Compliance Risk Management Policy |

The Compliance Risk Management Policy aims to facilitate the Bank and its employees’ compliance with applicable regulatory obligations through participation in training provided by the Compliance function, familiarization with relevant laws, regulations, codes of conduct, and best practice standards applicable to the business, and adherence to the Bank's implemented policies, procedures, systems, and controls. |

|||

| Sanctions Policy | The sanctions policy was developed to ensure compliance with regulatory obligations applied to the Bank both locally and internationally, in order to ensure that: (i) the risks arising from sanctions and terrorism financing are avoided, mitigated, and properly managed; (ii) the roles and responsibilities of the business areas are clearly defined; and (iii) a model is established for managing sanctions risk and terrorism-related risks.

The objective is to ensure that the Bank is protected from reputational damage and penalties, and that Bank employees are safeguarded against civil or criminal sanctions that may be imposed as a result of failure to identify or properly manage this risk. |

|||

| Minimum Sanctions Standards |

To ensure that minimum standards are understood, managed, and implemented throughout the Bank’s processes, including employee hiring, service contracting, client relationships, and operations, with the purpose of preventing the Bank from engaging with sanctioned or designated entities. |

|||

| Anti-Money Laundering and Combating the Financing of Terrorism Policy - AML/CFT |

The AML/CFT policy aims to ensure compliance with the legal obligations applicable to the Bank, in order to: (i) avoid and adequately manage the risks related to ML/TF; (ii) ensure that the Bank and its employees are protected from risks resulting from non-compliance; (iii) establish a framework that allows for the identification, investigation, and reporting of suspicious activities/transactions to the authorities; (iv) support global AML/CFT efforts and commit to establishing and maintaining adequate policies and procedures that facilitate AML/CFT compliance by adopting a risk-based approach. To this end, the Bank may refuse or terminate business relationships or transactions whenever it identifies that its services are being misused for ML/TF purposes. |

|||

| Market Abuse |

This Policy defines the Bank’s approach to monitoring, communicating, and mitigating the effects of Market Abuse situations. Employees must not, either intentionally or negligently, engage in any actions that may constitute a potential Market Abuse situation. |

|||

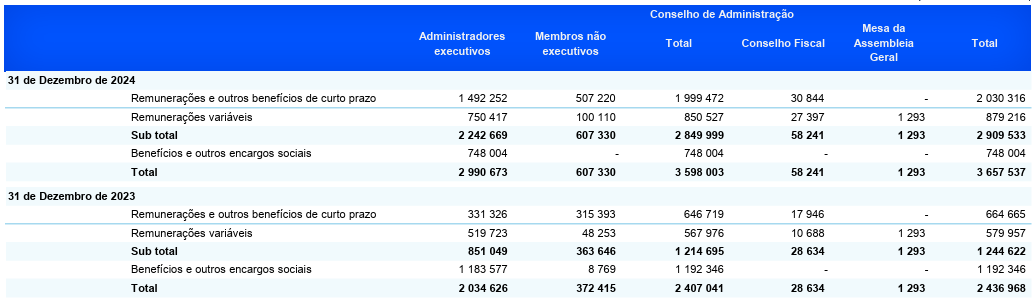

Remuneration of SBA's Governing Bodies

Remuneration of SBA's Governing Bodies